1 Short title 2 Interpretation. In section 33 of the Income-tax Act.

A Statutory Audit Is An Audit Which Is Made Mandatory Under The Companies Act 2013

All outgoings and expenses wholly and exclusively incurred during that.

. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source. See our editorial policies and staff. Earlier it was amended by the Income- tax Amendment Act 1963 w.

Classes of income on which tax. Section 33 Development rebate Income tax Act 1961. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1.

The Finance Act 1965 and the Finance No. In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely 3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the amalgamating company under sub. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

2 Act 1965 both with effect from 1- 4- 1965. A Digital eBook. 1A a An assessee who after the 31st day of March 1964 acquires any ship which before the date of acquisition by him was used by any other person shall subject to the provisions of section 34 also be allowed as a deduction a sum by way of development.

Long Title Part 1 PRELIMINARY. In short when you spend money to earn money youre allowed to deduct that cost from the income. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

The Finance Act 1965 and the Finance No. Earlier it was amended by the Income- tax Amendment Act 1963 w. September 15 2021 Post a Comment This is the amount you pay to the state government based on the income you make as opposed to federal income tax that goes to the federal government.

Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. The Andhra Pradesh Goods and Services Tax Act 2017. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and.

In short when you spend money to earn money youre allowed to deduct that cost from the income. Case Laws Acts Notifications Circulars Classification Forms Articles News D. This provision empowers the Comptroller of Inland Revenue to disregard vary or make such adjustments he deems appro.

Table of Contents. This is the new general anti-avoidance provision. Non-chargeability to tax in respect of offshore business activity 3 C.

TAX AVOIDANCE AND SECTION 33 OF THE INCOME TAX ACT This article discusses section 33 of the Income Tax Act introduced by the Income Thx Amendment Act 1988 repealing the old section. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. A capital nature on.

3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature. Section 331 Income Tax Act Income Tax Practice Notes Pdfcoffee Com. Section 33 1 of the Income Tax Act 1967 ITA reads as follows.

I after sub-section 1the following sub-section shall be inserted namely. Com Law and Practice. Section 331 Complete Act Try out our Premium.

2 Act 1965 both with effect from 1- 4- 1965. A capital nature on scientific research related to the business carried on by the assessee-. Charge of income tax 3 A.

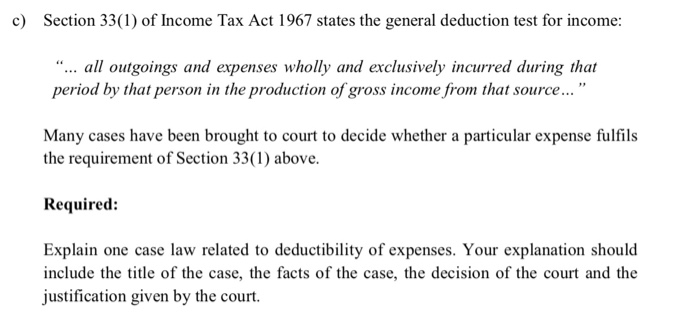

Section 33 1 of Income Tax Act 1967 states the general deduction test for income. Section 331 in The Income- Tax Act 1995 1 3 a In respect of a new ship or new machinery or plant. Whats New Latest Cases.

Income Tax Act 1947. Short title and commencement 2.

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Standard Deduction Tax Exemption And Deduction Taxact Blog

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Willing To Get Associated With A Performer

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Share Your Tax Issues With Us Tax Services Tax Refund Tax Preparation

1099 Nec Software To Create Print And E File Irs Form 1099 Nec

Understanding Your W 2 Controller S Office

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

How The Tcja Tax Law Affects Your Personal Finances

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)